Cashlet is a personal finance mobile app operated by Sycamore Capital that offers an easy way for Kenyans to save, invest, and grow their incomes online. Capital Markets Authority (CMA) recently approved the operation of Cahslet in Kenya.

How to create a Cashlet account and start saving

To create an account with the Cashlet app, follow the simple steps below:

- Download the Cashlet app from the Google Play Store for Android users or the App Store for iOS users.

- Create an account using your email and phone number, and then log in.

- After logging in, click on the “Activate Account” tab. You will be required to provide a photo of your ID, KRA pin, and a selfie as part of the Know Your Customer (KYC) process.

- Once your account is activated, click the “Transfers” menu at the bottom of the app.

- Select “Deposit Money” or “Withdraw Money.”

- You can deposit savings or withdraw earnings using Mpesa or your bank. The minimum deposit is Ksh. 100.

How Cashlet Saving Works

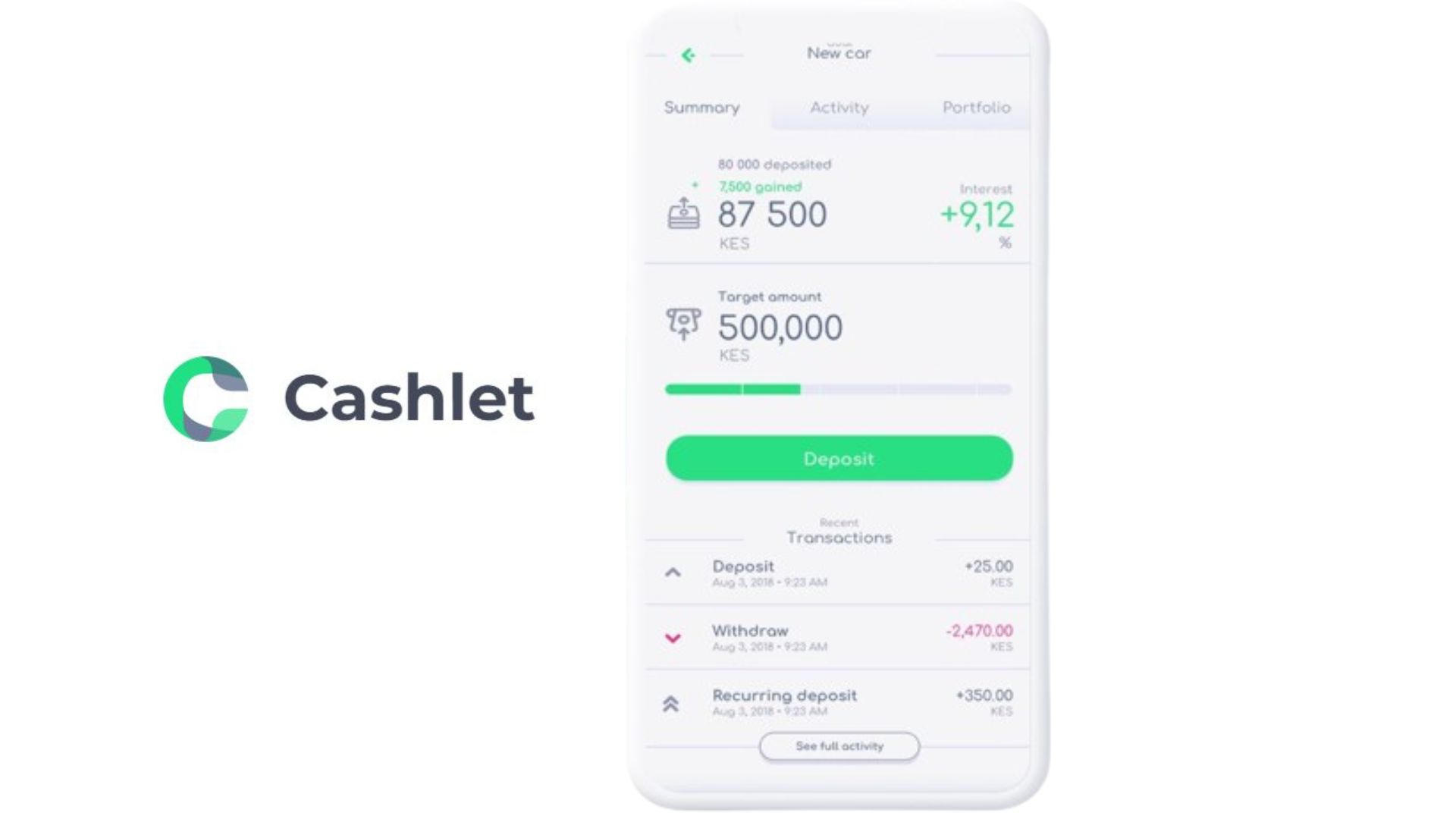

Cashlet allows you to set specific savings goals, target a particular amount for each goal, and stay focused on achieving the goal. You can create as many savings goals as you want, such as a housing plan, car purchase, wedding funds, etc.

You can start saving with as little as Ksh. 500 with an interest rate that ranges from 8 to 10% per annum, depending on the selected money market fund. Interest is accrued daily on your balance and is reflected on your dashboard at 10 am every day. You can withdraw all or part of the interest at the end of each month.

Your funds begin earning interest within 2 working days after depositing, and daily returns are credited to your Cashlet account by 10 am each day.

Investing using Cashlet App

You can invest in the money market fund, where your funds are combined with others and lent to the government, banks, etc. The interest paid by these entities is passed on to you. Currently, there is only one money market fund available for selection, the ICEA Lion Money Market Fund.

You have the flexibility to deposit or withdraw funds at any time, with no minimum investment period. The maximum withdrawal limit for M-pesa is KSH 10,000 per day, and there are no limits for bank transfers.

Leave a Comment