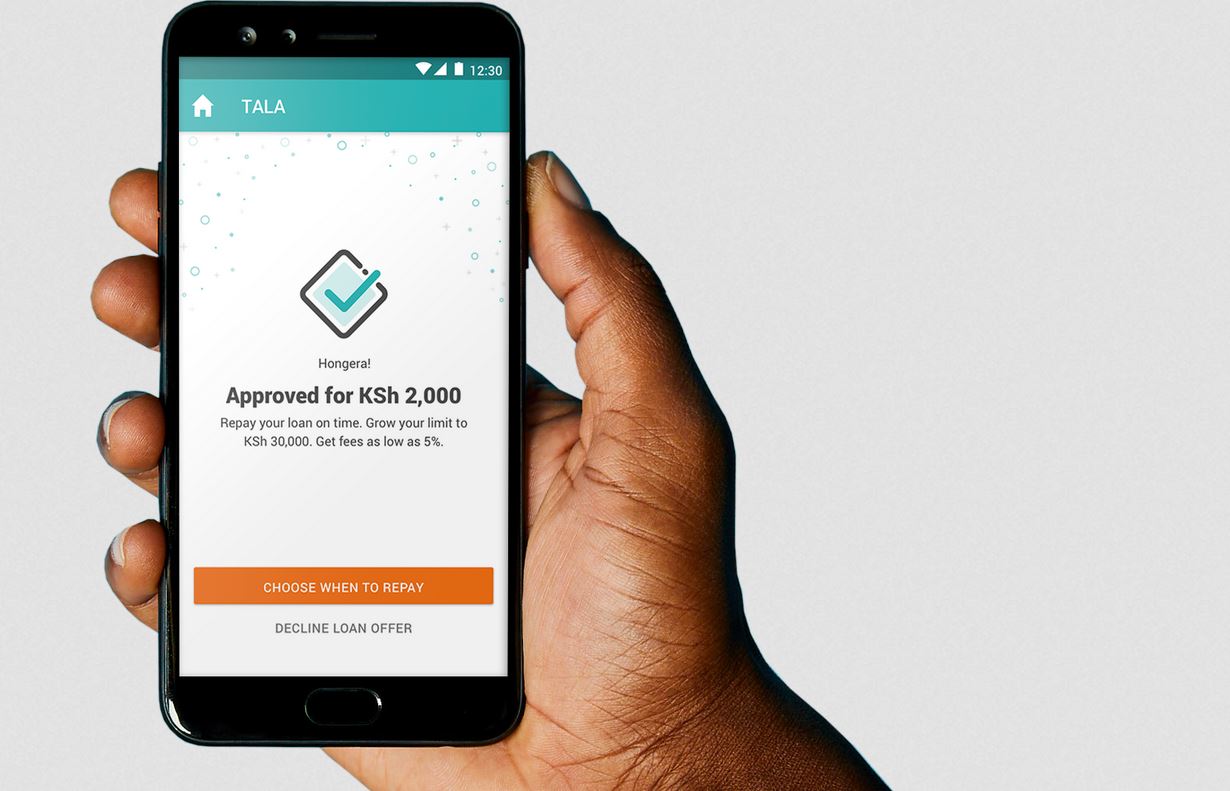

Tala App offers unsecured loans to Kenyans at a short repayment period. Learn how to Download Tala Android App, apply for a loan, and get it instantly via mpesa.

About Tala App

Tala App is an android mobile application that was founded by Shivani Siroya which provides lending services. In Kenya, it offers unsecured mobile loans to literary everyone who has an ID and is an active mpesa registered user.

As of writing this article it had over 5 million downloads on play store and a star rating of 4.6 out of 364,883 reviews.

Tala loan app works the same way as many other online mobile loan apps like Branch, Timiza e.t.c. Other countries that Tala operates include Mexico, Philippines, India, and Tanzania.

Requirements of applying for a Tala Loan and Limits

To be able to apply for a Tala loan in Kenya, you need to have a national ID, a registered mobile phone number, Mpesa account, and an android powered smartphone ( OS 4.0.3+).

You can borrow between ksh. 1,000 to 50,000 depending on your loan limit and credit score. Your loan limit will increase depending on a number of factors one of them being early repayment of loans.

Important: If you want your loan to be approved quickly without any security and lower low-interest rates, then we recommend Branch over Tala. Learn more about Branch Loan App.

How to Apply for Tala loan

To download Tala App follow the procedure below;

- Visit Google Play Store: Tala App Loan

- Download and Install the App

- Create your Tala Account by following the registration prompts

- Once you are done with registration process you will be able to see loan offers available to you depending on your credit score

- Apply for the loan that you qualify

- Tala app takes less than five minutes to process your loan.

- Afterwards, you will get a message both in your Tala account and mpesa of your loan disbursement.

Important: You cannot take another loan if you had taken one before and have not cleared repaying.

Tala Loan Interest Rates

Just like Branch, the interest rates do vary depending on the kind of loan you take and your repayment period.

For instance, loans that need 30 days to repay will incur interest rates ranging from 7% to 15% depending on your frequency of loan application. On the other hand, loans that require 21 days to repay charge 5% to 11% fee.

How repay Tala Loan

To repay your Tala Loan follow the procedure provided below;

- Go to Mpesa Paybill

- Enter Paybill Number: 851900.

- Account Number: Use your Tala registered phone number

- Amount: What you borrowed plus interest

- Pay and you are done

NOTE: If you have paid your tala loan and it has not reflected in your account, go to the Tala App and send the mpesa confirmation code via support App chat.

Tala Loan CRB Listing and Clearance

If you take more than 112 days to repay your loan. Your details will be submitted to CRB through Metropol, Creditinfo, and Transunion. To check if your name has been submitted to CRB by tala dial *433# and follow the prompts.

You can repay your outstanding loan to be cleared from CRB within 48 hours of working days. Tala does not however issue CRB clearance certificates. You will need to contact credit reference bureaus to get a clearance certificate.

Tala App error and troubleshooting

Below are solutions to common Tala App errors;

Payment not reflecting: Send the mpesa confirmation code, time of payment, and amount to Tala via the App chat section.

Lost verification code: Uninstall and reinstall the tala app, you will be sent a new verification code. Your account will not be lost.

Change Tala Pin: Go to the App and click forgot Pin to reset it

Blocked Pin: Take a photo of your ID and send it to Tala via the app chat

Device not supported: Tala only works on Android phones version 4.0.3+

Account Linked to another device: If you lost your phone or changed your device then you might encounter such an error. Kindly contact Tala support team using any of the sms means provided below so that they may unlink your previous account.

ID number has been registered: If you have never used tala app before and are getting this error message then this is a serious case of fraud. Somebody might have used your ID to register a sim card. You can sms tala to 2991 so that they can sought out the issue.

Not eligible: Even if you have repaid your first, second, third e.t.c loan in time. You might be surprised to apply for a fourth-time loan and find that you are not eligible. The reason is, Tala scans your mobile device data and if it notices you have not been sending SMS, calling, doing mpesa transactions e.t.c then lowers your loan limit or credit score. The solution here is just one, try another week or day.

Tala Loan Contacts

You can reach Tala customer care through;

- Email: hellokenya@talamobile.com

- Chat: Go to Tala App chat section

- SMS: send sms to 21991

- Website: https://tala.co.ke

This article was written by Joseph Mwaniki and Edited by Staff. Photo by Tala and slightly modified by the editor. Share your thoughts on Tala App Loan in the comment section below.

Leave a Comment